.jpg)

Insight

Value-based intermediation (VBI): Should it be mandatory?

Values-based banking is all about,

" Practicing banking in a way in which the priority of bankers is focused on enhancing society and the planet and get profit only as a consequence - a consequence of doing the right things and doing them the right way. " Marcos Eguiguren, Executive Director, Global Alliance for Banking on Values (GABV).

Aligning with this view, Bank Negara Malaysia (BNM) in late 2017, introduced the idea of Value-based Intermediation (VBI) to Islamic banks. Bank Negara Malaysia (BNM) defines VBI as:

" an intermediation function that aims to deliver the intended outcomes of Shari’ah through practices, conduct and offerings to contribute positively and sustainably to a wider range of stakeholders (environment, community and overall economy) without compromising shareholders’ financial returns and long-term interests. "

VBI is indeed a promising concept as it promotes real economic activities resulting in positive economic, social and environmental benefits to a wide range of stakeholders. What is indeed most pertinent is that the VBI concept aligns with the Maqasid Shariah and the concept is also in tandem with the objectives of secular sustainable finance.

CSR and VBI: The Difference

FIGURE I

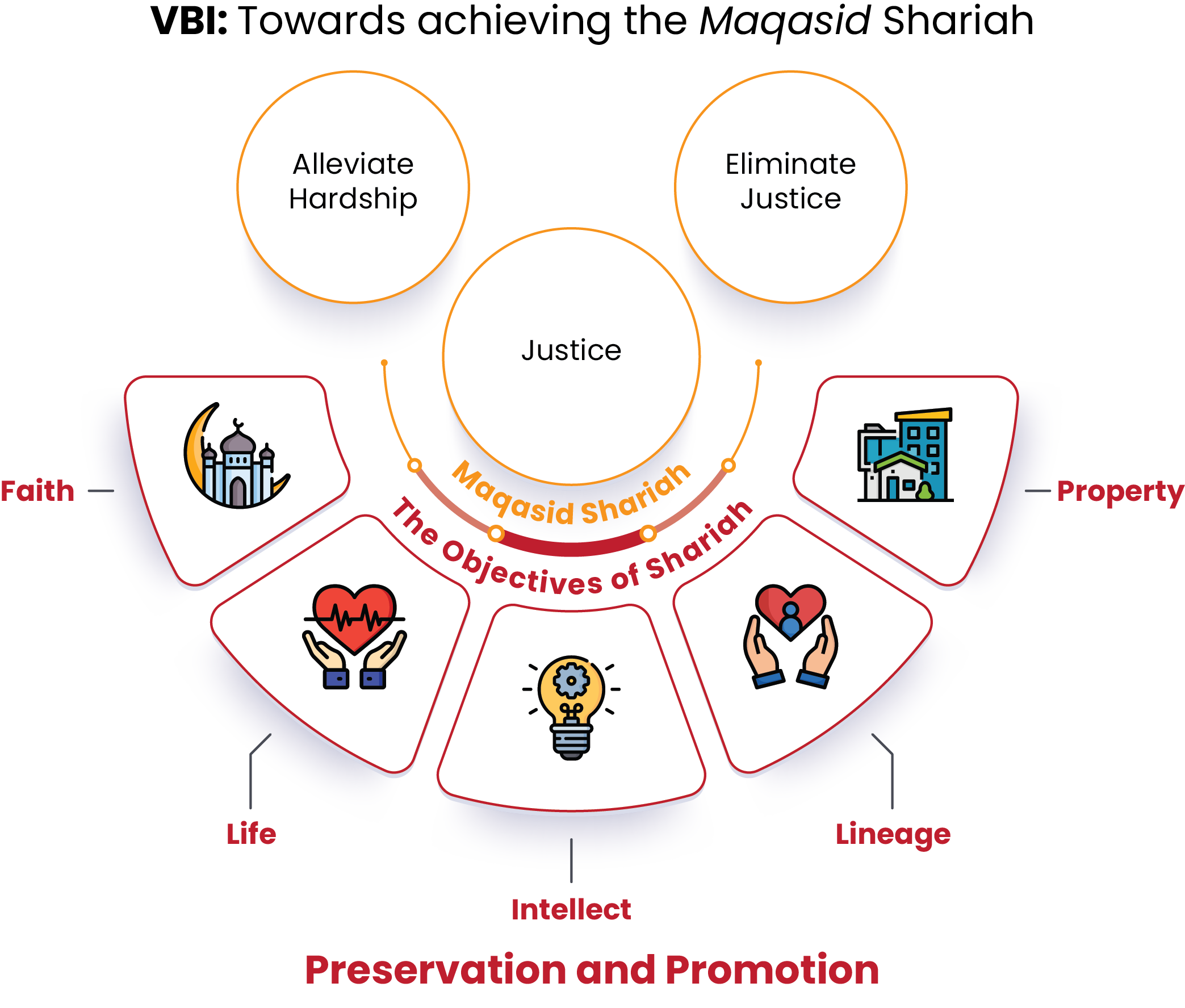

Whilst CSR is more a philanthropic exercise separate from the operations of an organization, VBI is all about integrating CSR practices with the business of the organization (see FIGURE I). Clearly, VBI is all-encompassing, and that its objectives do align perfectly with the objectives of the Shariah (Maqasid Shariah). Given that the objectives of the Shariah are primarily to preserve the Faith or religion (din), Life (nafs), Lineage (nasl), Intellect (‘aql) and Property (mal) (see FIGURE II), adopting VBI would reflect the true essence of Islamic finance.

FiGURE II

Bank Negara Malaysia’s Guidance Documents

1. The Implementation Guide for VBI

This document provides guidance on practical value-based banking practices, as reference to Islamic financial institutions that intend to embark on the Value-based Intermediation initiative. It also outlines the phases of implementation and deliberates on key implementation challenges alongside some pragmatic solutions;

2. The VBI Financing and Investment Impact Assessment Framework (VBIAF)

This document facilitates the implementation of an impact-based risk management system for assessing the financing and investment activities of Islamic banking institutions in line with their respective VBI commitment; and

3. The VBI Scorecard

The scorecard provides an overview that covers purposes, key components of assessment and proposed measurement methodology. It is hoped that the above documents would facilitate the adoption of VBI by Islamic banks in Malaysia. The formation of the VBI Community of Practitioners (CoP) thereafter was indeed a step in the right direction.

BNM stresses that Islamic banks must ensure that their strategy should manifest the four underpinning VBI principles: entrepreneurial mindset, community empowerment, good self-governance and best conduct (see FIGURE III). BNM further highlighted that VBI emphasizes on “value creation and value-based businesses that reflect the true essence of Islamic finance". Adopting VBI promotes transparency and fairness in the conduct of Islamic banks. This would in turn lead to greater consumer confidence. More importantly, the impact-focused performance would indicate the socio-economic and environmental impacts of any action undertaken, thus ensuring the Islamic bank’s goal on sustainability and attaining the Maqasid Shariah are achieved simultaneously.

FIGURE III

An Enabling Environment

To ensure that VBI is adopted by all Islamic banks, BNM focuses on four key strategies to create an “enabling” environment: nurturing potential champions, enhanced disclosure, strategic networking and performance measurement (see FIGURE IV).

1. Nurturing Potential Champions

BNM will nurture potential champions or leaders to showcase success stories.

2. Enhanced Disclosure

Islamic banks are expected to enhance their disclosure on the commitment, implementation strategies and KPIs.

3. Strategic Networking

BNM will develop a strategic collaboration with established value-based communities, key partners and stakeholders.

4. Performance Measurement

BNM, in collaboration with industry players, will develop and introduce the “value-based scorecard” as a common and complementary performance measurement tool.

With the above strategies in place, BNM has left the specifics of implementing VBI at the discretion of

Islamic banks.

FIGURE IV

Implementing VBI: Voluntary? Mandatory?

Since VBI is very much in line with the fundamentals of Shariah, it would mean that Islamic banks would take this on board, readily. Accordingly, BNM has not made its adoption, mandatory. This, according to Gulzhan Musaeva (Eco Business, November 2020) is not the way to go and that BNM’s trust in Islamic banks is, indeed, misplaced. She added that for VBI implementation to be successful, each Islamic bank should be made accountable and for that, there should be “firm and coherent regulation” on the part of BNM.

Without formal regulations, one may witness “indefinite timelines and loose interpretations” of VBI implementation. This may subsequently lead to “greenwashing and ineffectiveness.” Finally, on the need to have VBI made mandatory, she emphasized that, "…..the proactive approach to policymaking is well suited for rule-based systems in emerging markets and developing countries….." and that the " informal or market-driven approaches that leave the uptake to be voluntary should complement, not replace, full-fledged regulation to create a truly enabling environment for sustainable businesses." Gulzhan Musaeva, Eco Business, November 2020.

The issue as to whether VBI is made mandatory or otherwise, is important. However, of more importance is the need to shift the mental paradigm of industry captains of Islamic banks from that of compliance to that of conscience.

As emphasized by Encik Abdul Rasheed Ghaffour, the Deputy Governor of the Central Bank of Malaysia at the VBI Dialogue in Kuala Lumpur on 24th August 2017, " …..VBI calls for a "transformation of the mind", a change in how we think and how we act. It takes a long view to recognise returns beyond profits where social and environmental gains are also equally valued. This will represent a major paradigm shift in many institutions. For this, strong and visionary leadership that sets the tone from the top, starting from the board and senior management, is certainly crucial. Far-sighted leadership to transform culture, systems and people will be central to this paradigm shift."

Essentially, this is all about having VBI internalised in industry players. It is when this is realised that Islamic banking would move towards sustainability as envisioned in the 17 UN sustainable development goals (UNSDGs). Most importantly, this will enable Islamic finance to move towards achieving the Maqasid Shariah.

.jpg)

-.jpg)